President Joe Biden’s administration continues to influence the financial markets as investors look ahead to 2025. Leading brokers have identified promising stock picks based on current economic trends and future projections.

- Growth Sectors for 2025: Technology (AI leaders like Alphabet, Nvidia), healthcare (biotech, pharmaceuticals), and renewable energy are top picks for investment.

- Impact of Biden’s Policies: The administration’s emphasis on clean energy and carbon reduction boosts confidence in renewable energy stocks.

- Portfolio Diversification: Experts recommend balancing established firms with emerging players and considering global trends to mitigate risk.

- Advice for New Investors: Start with index funds to gain broad market exposure, then explore ETFs and mutual funds for diversified growth opportunities.

Financial experts from six top brokerage firms shared their insights on which stocks could perform well. They point to sectors like technology, healthcare, and renewable energy as potential growth areas.

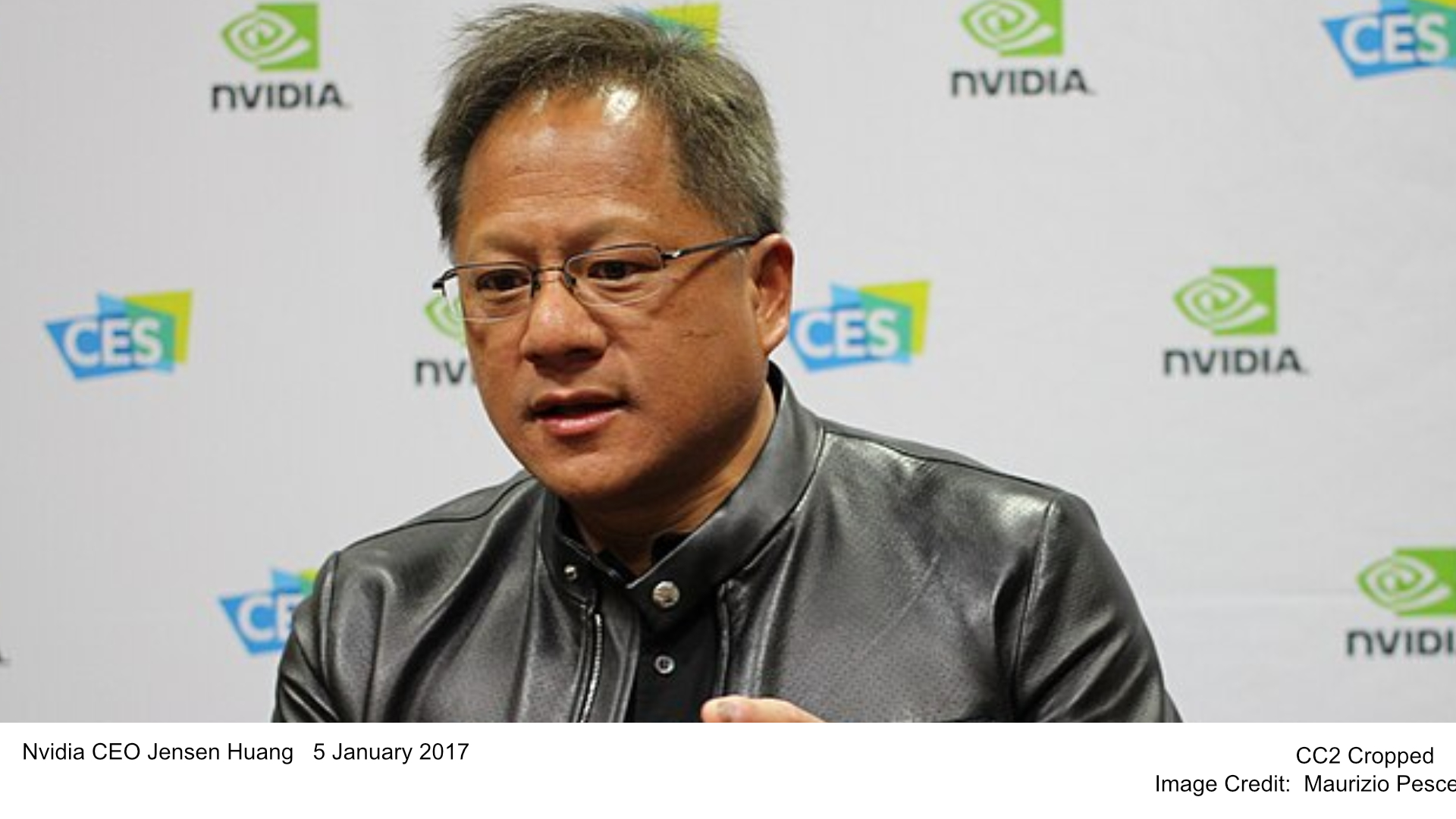

Technology continues to be a focal point for investors. Companies leading in artificial intelligence, such as Alphabet and Nvidia, are expected to see significant growth. These firms are at the forefront of innovation, developing transformative technologies that could redefine entire industries.

Healthcare stocks remain attractive due to ongoing advancements in biotechnology and pharmaceuticals. Firms involved in developing new treatments and vaccines are gaining attention. With an aging global population, the demand for healthcare services is set to rise, benefiting companies in this sector.

Renewable energy is another area of interest. The Biden administration’s commitment to reducing carbon emissions and promoting clean energy has boosted investor confidence. Companies involved in solar, wind, and electric vehicle technologies are likely to see increased demand.

Financial experts also highlight the importance of diversifying portfolios. Investing in a mix of established companies and emerging players can mitigate risks while offering growth opportunities. They advise investors to consider global market trends and geopolitical factors that could impact returns.

For those new to investing, brokers recommend starting with index funds. These funds provide exposure to a broad range of stocks, reducing the risk associated with investing in individual companies. As investors gain experience, they can explore other options, such as exchange-traded funds and mutual funds.

The stock market in 2025 offers numerous opportunities for growth. By focusing on technology, healthcare, and renewable energy, investors can position themselves for potential success. Consulting with financial advisors and staying informed about market trends will be crucial in navigating this dynamic landscape.

Stock Market Soars in 2024 Amidst AI Boom and Economic Growth

In 2024, the stock market experienced remarkable growth, with the S&P 500 climbing 23%, marking its second consecutive year of over 20% gains. This surge was largely driven by advancements in artificial intelligence (AI) and robust economic performance. Major technology companies, including Apple, Nvidia, Microsoft, Amazon, and Meta Platforms, played pivotal roles in this rally, significantly boosting market indices.

The Nasdaq Composite also saw substantial gains, rising 28.6% and closing the year at 19,310.79. This growth was fueled by investor enthusiasm for AI innovations and strong corporate earnings. Notably, Reddit’s stock price soared by 380% following its initial public offering, reflecting the market’s appetite for tech-driven growth.

Despite this optimism, some analysts caution about potential market volatility in 2025. Concerns include high valuations, possible economic disruptions from policy changes under President-elect Donald Trump, and the sustainability of the AI-driven rally. Investors are advised to remain vigilant and consider diversifying their portfolios to mitigate potential risks in the coming year.

Resources:

- Financial Times: Will US markets keep rising under Trump?

- MarketWatch: Active mutual funds struggle to beat large-cap stock benchmarks – again

- Investors.com: Amazon, Google Power These Best IPOs 2024 To New Highs; Reddit Trounces Palantir

- Barron’s: Everyone Is Looking for a Value Stock Resurgence. Don’t Hold Your Breath.

- Business Insider: The under-the-radar hedge funds that killed it in 2024

- Wall Street Journal: Stock Funds Rose 17.4% in 2024

- MarketWatch: The stock market rarely scores hat tricks. This strategist fears what’s next.

- Reuters: Markets in 2024: Wall Street’s high-octane rally keeps investors captive to the US

- Associated Press: Stock market today: Wall Street indexes lose ground as market closes another record-breaking year

- Investors.com: Dow Jones Futures Rise To Start 2025; Tesla Climbs With Deliveries Due

- The Times: The leaders and the laggards in a turbulent 2024

- Morningstar: 2024 in Review and 2025 Market Outlook

- Bloomberg: “2025 Stock Market Outlook: Top Picks from Leading Analysts.”

- Reuters: “Biden’s Energy Policies and Their Impact on Investment Trends.”

- MarketWatch: “AI, Healthcare, and Renewables: Where to Invest Next Year.”

Be First to Comment