Donald Trump’s anticipated return to the White House has begun to impact the US Federal Reserve’s outlook. Uncertainty surrounding his policy proposals has raised concerns about potential conflicts between the central bank and the president-elect. Fed Chair Jerome Powell acknowledged that Trump’s economic platform was a consideration during the recent rate-setting committee meeting.

- Trump’s Influence on the Fed: The Federal Reserve is factoring in the potential impact of Donald Trump’s economic policies, including tariff hikes and tax cut extensions, as it shapes its monetary policy.

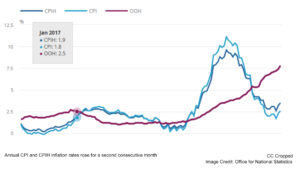

- Interest Rate Outlook: The Fed recently cut interest rates by 0.25%, but it anticipates fewer rate cuts in the coming year due to persistent inflation concerns and uncertainty surrounding Trump’s policy agenda.

- Global Economic Updates: Upcoming economic data, including US consumer confidence and durable goods orders, UK GDP figures, and updates from Japan and Russia, will be closely monitored for their influence on the Fed’s future actions.

- Investor Sentiment: Markets remain cautious as the Fed attempts to balance economic stability with potential political and policy pressures.

According to CNBC, Trump’s policies, including potential major tariff hikes, tax cut extensions, and mass deportation plans, are influencing the Fed’s decision-making. These policies could alter the expected number of interest rate cuts next year. The Fed’s cautious approach reflects its attempt to balance economic stability with potential political pressures.

The Federal Reserve recently cut its key interest rate by a quarter-point as anticipated. However, the central bank signaled it expects a slower pace of rate reductions next year due to lingering inflation concerns. New projections suggest rates might fall by only 50 basis points in 2025.

Economic analysts are paying close attention to upcoming data releases that could further influence the Fed’s policy direction. On Monday, the UK will release its quarterly GDP figures, and the US will report consumer confidence data. On Tuesday, the US will announce durable goods orders and new home sales figures. The Bank of Japan will also update its inflation data. Later in the week, the US will release jobless claims figures, and Russia will announce its monthly GDP.

As the Fed navigates these uncertain times, investors remain cautious about the potential implications of Trump’s policies on economic stability. The central bank’s decisions will likely continue to shape market expectations and investor sentiment.

Be First to Comment