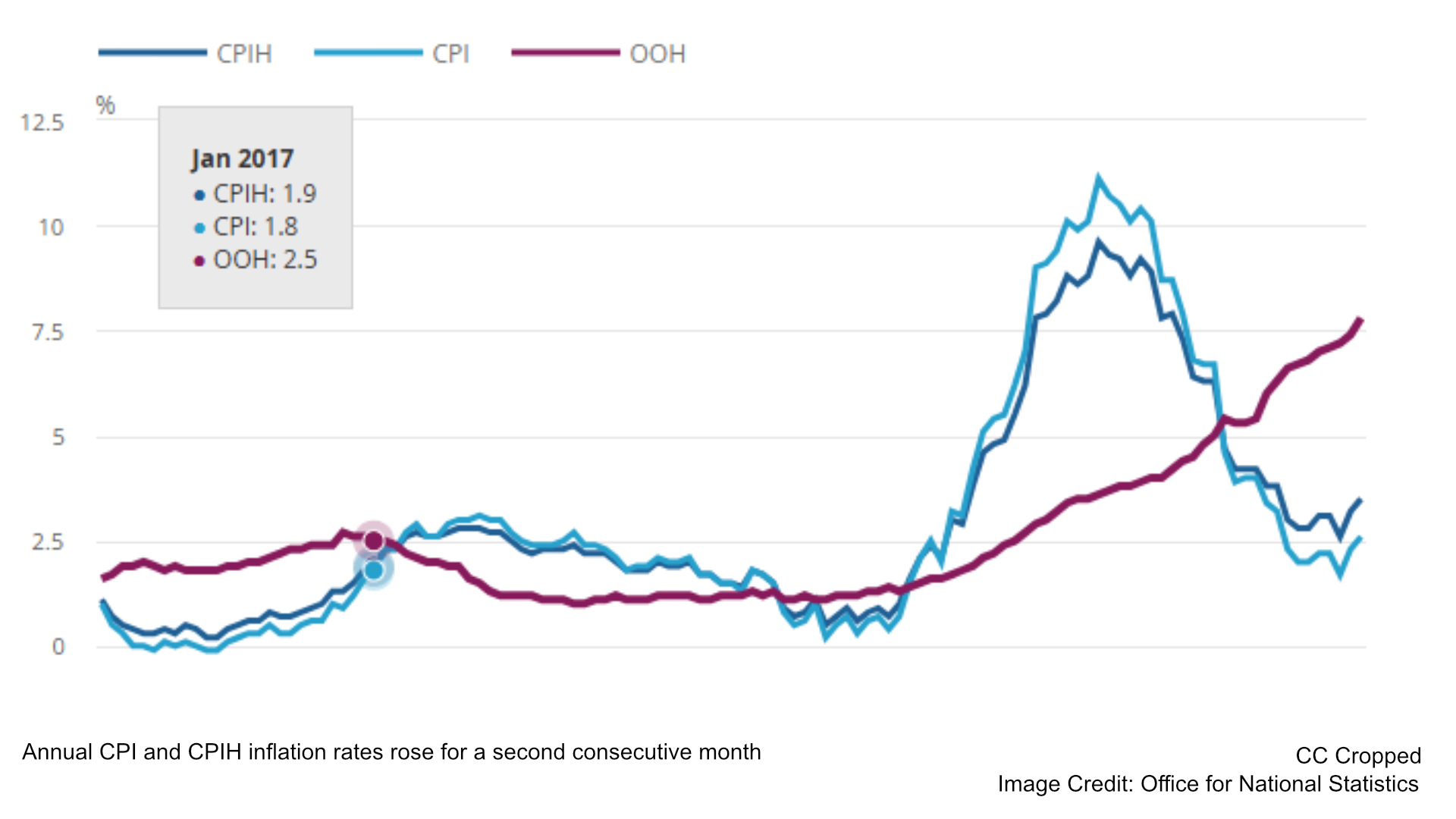

The UK’s inflation rate has reached its highest level since March, marking a significant economic challenge. The Consumer Prices Index (CPI) rose by 2.6% in November from October’s 2.3%, exceeding the Bank of England’s target of 2%. This rise is attributed to increased costs in petrol, groceries, and tobacco, as reported by the Office for National Statistics (ONS). The inflation rate’s upward trajectory has raised concerns about the Bank of England’s monetary policy decisions.

- Inflation Hits a High: The UK’s Consumer Prices Index (CPI) rose to 2.6% in November, driven by higher fuel, grocery, and tobacco costs, surpassing the Bank of England’s 2% target.

- Economic Challenges Mount: Rising petrol and diesel prices, along with increased tobacco duties, are significant contributors, while falling airfares offered limited relief.

- Monetary Policy Dilemmas: The Bank of England faces pressure to manage inflation without raising interest rates, currently at 4.75%, as wage growth and declining GDP complicate its strategy.

- Impact on Households and Businesses: Rising property prices, rents, and declining industrial orders signal mounting financial strain for families and businesses alike.

The ONS reports that petrol prices increased by 0.8 pence per liter, reaching 134.8 pence, while diesel saw a 1.4 pence rise to 140.5 pence. This increase in fuel costs is a significant driver of the inflation rate. Additionally, the November budget hike in tobacco duty further contributed to this rise. Despite these increases, air fares experienced a record drop of 19.3%, reflecting lower prices on European routes.

Chancellor Rachel Reeves acknowledged the challenges faced by families due to the rising cost of living. She emphasized the government’s commitment to easing financial burdens by putting more money into the pockets of working people. This comes amid a backdrop of rising inflation rates in essential goods and services, including food, clothing, and recreation.

The Bank of England remains cautious about adjusting interest rates, with a current level of 4.75%. Analysts suggest that the Bank will likely maintain this rate to manage inflationary pressures. Recent figures showing accelerated wage growth add to the complexity of the Bank’s decisions. Financial markets indicate a high probability that the Bank will keep interest rates unchanged in the near term.

Economists caution that rising inflation will impact consumer expectations, potentially affecting economic growth. The Bank of England’s priority remains controlling inflation, even if it means slower economic growth. The Bank had previously forecasted a temporary rise in inflation towards the year’s end, following a significant drop earlier in the year.

Economic indicators suggest a slowdown, with GDP unexpectedly falling by 0.1% in October. Business surveys highlight declining employment levels, reminiscent of the global financial crisis. The Confederation of British Industry (CBI) reports a collapse in total orders at UK factories, further emphasizing economic challenges.

Property prices and rental costs continue to rise, exacerbating household financial pressures. The ONS data shows annual growth in house prices and rents nearing record highs. Core inflation, which excludes volatile items, also rose, indicating broader inflationary pressures.

As the UK navigates these economic challenges, the Bank of England’s decisions will be crucial in shaping the country’s financial landscape. The government’s fiscal policies, including changes in employer national insurance contributions, add another layer of complexity to the economic outlook. Balancing inflation control with economic growth remains a central focus for policymakers.

Be First to Comment