Chancellor of the Exchequer Rachel Reeves expressed dissatisfaction with the figures, emphasizing the need for stronger growth. She highlighted her recent Mansion House speech, where she announced significant pension system reforms to unlock up to £80 billion for investment in small businesses and infrastructure. Reeves acknowledged the challenges faced by the new government, stating that more efforts are needed to improve growth.

- Economic Growth Concerns: Chancellor Rachel Reeves emphasized the need for stronger economic growth, citing recent reforms to the pension system aimed at unlocking £80 billion for small businesses and infrastructure investment.

- Growth Challenges: The UK trailed the G7 in third-quarter growth, with the services sector expanding by only 0.1%, despite stronger performance in construction.

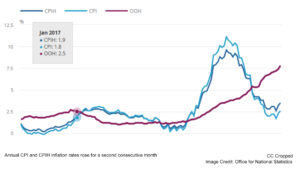

- Inflation and Policy Shifts: The Bank of England’s base rate cut to 4.75% aims to stabilize inflation, expected to reach 2% by 2027, though recent measures could spur inflation in the short term.

- Government Strategy: Efforts to reduce financial red tape and focus on public infrastructure and supply-side reforms are central to the government’s long-term growth strategy.

The sluggish growth placed the UK at the bottom of the G7 growth table for the third quarter, trailing behind the US and the Eurozone. The services sector, which constitutes a significant portion of the UK economy, expanded by only 0.1%, offsetting the 0.8% growth in construction. The Bank of England’s recent 0.25 percentage point base rate cut to 4.75% aims to address inflation, which is expected to stabilize at 2% by 2027.

The UK economy’s performance contrasts with the strong growth seen in the US and other G7 countries. Economists have linked the slow growth to uncertainty surrounding recent budget announcements and the long-term impacts of Brexit. The Chancellor’s recent measures, including reducing financial red tape, aim to boost growth and improve productivity.

The Bank of England’s quarterly report suggests that Reeves’s £70 billion tax and borrowing measures could increase inflation and GDP next year. However, the government’s focus on public infrastructure investment and supply-side reforms aims to drive growth in the medium term.

Be First to Comment