The UK’s economic landscape is undergoing significant changes following the announcement of the largest tax hikes in a generation. The pound has experienced a sharp decline over the past three days, marking its most significant fall in 18 months. Sterling’s value against both the dollar and euro has dropped, reflecting market uncertainty.

- The UK’s largest tax hikes in a generation have led to sharp declines in the pound, falling against the dollar and euro, and a rise in 10-year bond yields, signaling market concerns about the country’s fiscal stability.

- The budget’s effects on borrowing costs echo, though less dramatically, the market volatility seen after Liz Truss’s 2022 “mini-budget,” with bond yields rising 0.3% since the budget’s announcement.

- Economists and organizations like the IFS warn that further tax increases or spending cuts may be necessary to prevent a £9 billion shortfall, particularly as some fiscal policies, such as the increased stamp duty for second homes, could strain the rental market.

- As fiscal rules aim to stabilize public finances, the government is committed to increasing public service funding by 2% annually, though future spending reviews will determine how sustainable this approach is amid economic headwinds.

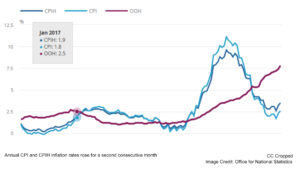

The cost of government borrowing, indicated by 10-year UK bond yields, has surpassed 4.5% for the first time in a year, nearing the danger zone identified by the Office for Budget Responsibility (OBR). Ed Conway, Sky News’s economics and data editor, noted that while European bond yields have also risen, the UK’s situation seems more rapid and concerning.

The budget’s impact on market dynamics has been notably intense, with Conway commenting on the unusual market reactions. These developments reduce Chancellor Rachel Reeves’s fiscal flexibility, raising questions about the government’s future financial strategies.

This market volatility echoes the aftermath of Liz Truss’s “mini-budget” in September 2022, which led to a borrowing cost surge and a 37-year low for the pound against the dollar. Although the current situation is not as dire, it is enough to concern Treasury officials. Traders are scrutinizing the government’s borrowing levels, potentially leading to increased future borrowing costs.

Jack Meaning, UK chief economist at Barclays, described the market reaction as markedly different from 2022’s events. Bond yields have risen by about 0.3% since Reeves’s budget, compared to a 1.5% increase in 2022. The focus now is on the OBR’s comments about potential inflation rises and the Bank of England’s upcoming interest rate decisions.

The government’s spokesperson refrained from commenting on bond prices, emphasizing the budget’s goal of restoring fiscal stability. New fiscal rules aim to place public finances on a sustainable path, though the government’s borrowing and spending plans will face challenges.

The Institute for Fiscal Studies (IFS) warns that more tax hikes may be necessary to avoid £9 billion in spending cuts during this Parliament. The IFS’s Paul Johnson emphasized the difficulty of maintaining the proposed spending envelope and the potential for real-terms cuts in some departments.

The IFS also criticized the government’s decision to increase the stamp duty land tax surcharge for second homes and buy-to-let properties. This move, deemed economically damaging, could impact landlords and renters as the supply of such properties decreases.

Despite these challenges, the government remains committed to its spending plans, with day-to-day funding expected to grow an average of 2% per year in real terms. This investment aims to enhance public services compared to previous plans, though the next spending review will outline further departmental plans and reforms.

Overall, the UK’s economic landscape faces significant challenges as it navigates tax hikes, market reactions, and evolving fiscal policies. The government’s strategies will be crucial in shaping the country’s financial future and addressing the concerns of businesses, workers, and economists.

Be First to Comment